who pays sales tax when selling a car privately in illinois

However you do not pay that tax to the car dealer or individual selling the car. Take alluring pictures of your car.

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Transparent Flexible Fixed-Fee Pricing.

. Cost of Buying a Car in Illinois Increased in 2020. CarMax Offers You an Easy and Reliable Way to Sell Your Vehicle. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

So you get a credit for the Missouri sales tax you pay on your vehicle purchase. In addition to completing the application form you. Ad Your Business Partner for All Things Sales Tax.

Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Heres how the law works.

Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales. For vehicles worth less than 15000 the tax is based on the age of the vehicle. It ends with 25 for vehicles at least 11 years old.

I bought a hybrid car recently. Buff out any scratches. However as of July 1 2008 the Ministry of Finance adopted a proposal that would subject an incentive payment to the plant to VAT only if the payment is related to a specific sale.

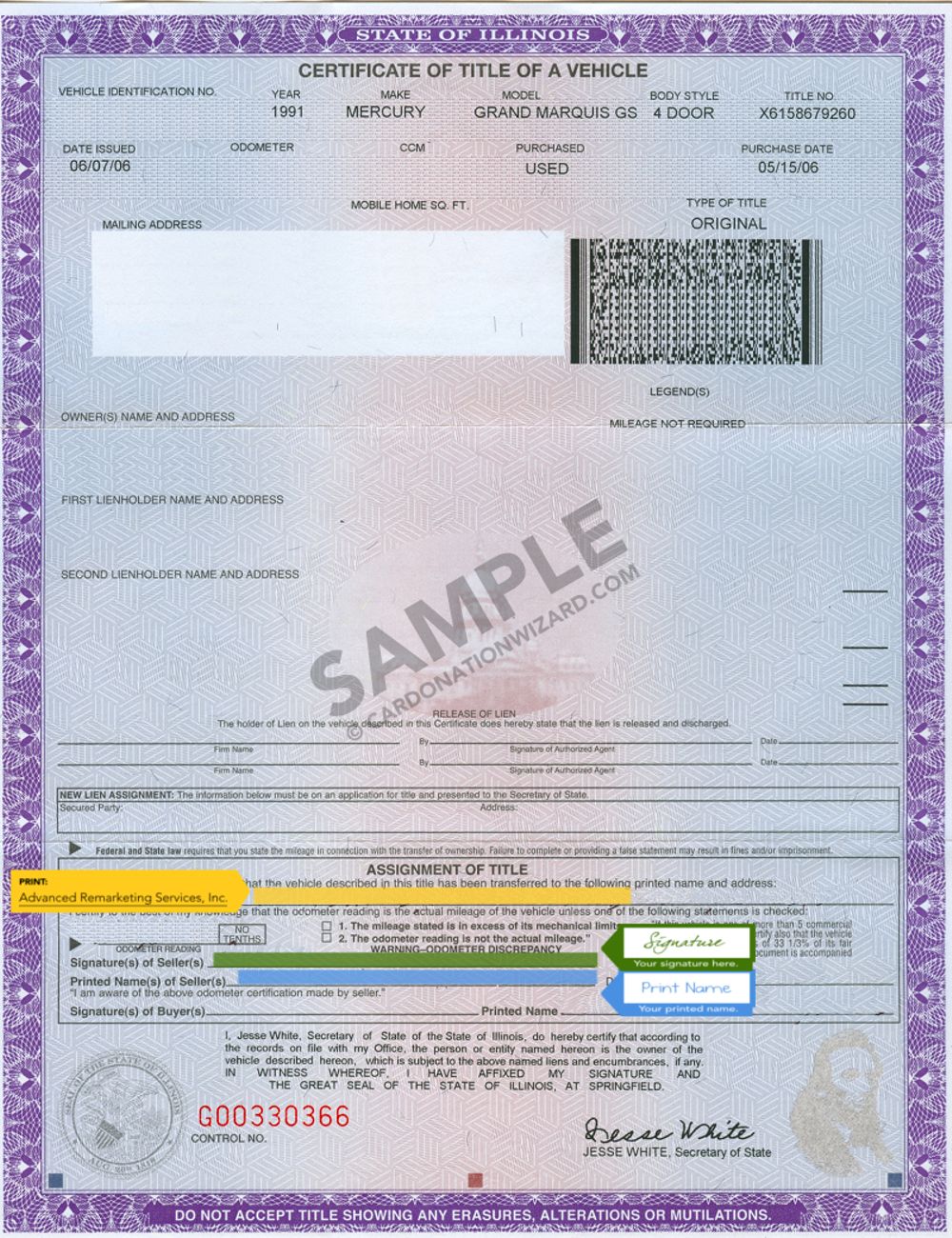

Instead the buyer is responsible for paying any sale taxes. You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. Youll need to have the title sales tax form and other paperwork which varies according to the situation.

To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. Cost of buying a car in illinois increased in 2020 Buyers must pay a transfer tax when they buy a car from a private seller in illinois although this tax is lower when you buy from a private party than when you buy from a dealer. Get a car wash.

As a result of this decision the Ministry of Finance adopted the position that all incentives to factories are subject to VAT. Remove all trash from the vehicle. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

To get started selling a car in Illinois take these steps to get it ready. Do not let a buyer tell you that you are supposed to. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

When you sell your car you must declare the actual selling purchase price. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

In addition to state and county tax the City of Chicago has a 125 sales tax. You will pay it to your states DMV when you register the vehicle. This important information is crucial when youre selling.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person. There is also between a 025 and 075 when it comes to county tax.

Once the lienholder reports to flhsmv that the lien has been satisfied. See our Title Transfers in Illinois page for complete details. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. Taking these steps will help you get the car ready to sell and for prospective buyers to look at. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation.

Who Pays Sales Tax When Selling a Car Privately in Illinois. However you the lessee may be required to assume this responsibility. Take out all personal belongings.

However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000. If youre buying a car for 40000 and your trade in is worth 20000 you only have to pay tax on the difference which in this case is 20000. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference.

You can process the transaction at your local Secretary of State office or by mailing the paperwork to the Secretary of States main office. Ad CarMax Offers You an Easy and Reliable Way to Sell or Trade In Your Car. The buyer will have to pay the sales tax when they get the car registered under their name.

For vehicles that are being rented or leased see see taxation of leases and rentals. It starts at 390 for a one-year old vehicle. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer.

Who pays sales tax when selling a car privately in Illinois. Fill out a Private Party Vehicle Tax Transaction form. This tax is paid directly to the Illinois Department of Revenue.

The total amount of tax collected depends on the cars model year and the price paid. Thats 2025 per 1000. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

With any private car sale in the state buyers must submit Tax Form RUT-50 and pay the 625 state sales tax to the county tax collector. This rate doesnt include any additional county taxes or title transfer fees. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois.

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Which U S States Charge Property Taxes For Cars Mansion Global

Illinois Used Car Taxes And Fees

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

A Complete Guide To Car Dealer Fees Carfax

If You Win A Car Should You Keep It Or Take Cash

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago

Who Pays Taxes On A Gifted Vehicle Sell My Car In Chicago

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

How Do I Sell My Car Illinois Legal Aid Online

How To Sell A Car Without A Title Kelley Blue Book

Buying From A Private Seller Vehicle Registration Titling And Fees Explained